Nearly every advisor has experienced the frustration of failing to connect with a potential client and experiencing the sinking feeling that you are speaking different languages. For some reason, the same discussion that you’ve had many times before with other clients fails to resonate.

Nearly every advisor has experienced the frustration of failing to connect with a potential client and experiencing the sinking feeling that you are speaking different languages. For some reason, the same discussion that you’ve had many times before with other clients fails to resonate.

The key strategy in successfully connecting with a potential client as quickly as possible is identifying their motivation and what drives them. Once you understand what’s important to this individual, you can speak their language.

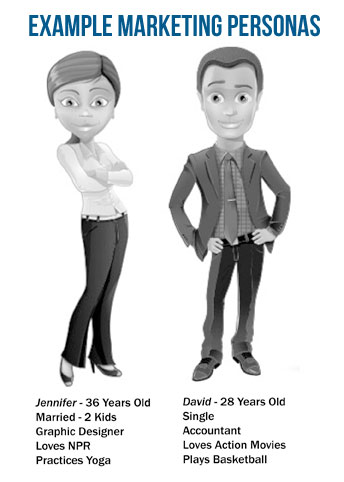

In marketing terms, we create what are known as customer or marketing personas to help identify and categorize potential buyers. A customer persona is a vivid identification with as many key parts as possible of your targeted customer. Components could consist of gender, age, profession, education, income, family, hobbies, interests, worries, concerns and much more.

The best customer personas provide a crystal clear representation of a group of like-minded individuals with whom you often sell to. You could have one or multiple customer personas that you’re looking to target. The best customer personas have the most information and are able to create the most vivid realization of that customer.

Creating customer personas helps you determine what’s most important to each individual; set the tone, style, and delivery strategies for your message; target the topics you should be discussing; and understand where buyers find and consume information.

The Small Business Digital Marketing Playbook: How to Attract and Retain the Next Generation Customer“, I identified my customer personas as key stakeholders for small and medium-sized businesses. Every page that I wrote and every topic that I researched, I thought in terms of what my audience would want or need. I had a very clear vision of their key characteristics, which helped me to refine the various aspects of each topic that was covered.

The best illustration of customer personas of high net worth investors comes from the book “The Millionaire’s Advisor: High-Touch, High-Profit Relationship Strategies of Advisors to the Wealth“. Authors Russ Alan Prince and Brett Van Bortel introduce the “High Net Worth Psychology” framework, which includes grouping high net worth investors by their motivations.

The best illustration of customer personas of high net worth investors comes from the book “The Millionaire’s Advisor: High-Touch, High-Profit Relationship Strategies of Advisors to the Wealth“. Authors Russ Alan Prince and Brett Van Bortel introduce the “High Net Worth Psychology” framework, which includes grouping high net worth investors by their motivations.

High Net Worth Psychology is basically a systematic way of communicating and working with affluent investors. By identifying which of nine groups a potential client most resonates with, you’ll be able to understand their motivation and speak their language. Consider it a translation tool for identifying communication preferences of high net worth investors.

Here are the nine High Net Worth Personalities along with a brief synopsis of the motivators:

- Family Stewards are the most prevalent of the high-net-worth personalities. They’re motivated by the need to protect their families over the long term. This makes them suitable candidates for a wide range of professional services. Advisors should stress reassurance when talking with Family Stewards about performance and emphasize their experience in working with family issues.

- Investment Phobics are people who—although they’re wealthy— don’t enjoy thinking about money. They also believe they are not especially capable of effectively managing the professionals they turn to for assistance. Advisors should avoid technical discussions while spending time to learn more about the outside interests of this group.

- Independents include people whose primary objective in accumulating wealth is to achieve financial independence and security. Some want to retire from their financial obligations to enjoy life; others will continue to be involved but value the security of knowing they could leave at any time. Advisors should discuss investment performance as it relates to the goal of this group – financial freedom.

- Anonymous are typified by a deep-seated—and sometimes irrational—need for privacy and confidentiality in all of their financial and sometimes personal dealings. They consistently fear that the disclosure of information will enable someone to gain control over them and their affairs. Emphasize your firm’s commitment to client confidentiality and your security procedures when communicating with this group.

- Moguls are driven to accumulate wealth in order to achieve personal power and influence. Their primary motivation is to leverage the power conferred by wealth. Advisors should create decision-points for this type of client to allow them to be part of the decision making process. Moguls need to feel as though they are your firm’s #1 client.

- VIPs are motivated to accumulate assets and utilize their wealth to achieve greater prestige and social status. This personality type prizes the opinion of select others above all else. When communicating with this group, advisors should emphasize the quantity and quality of resources being utilized on their behalf. Focus on making VIPs feel as though they are in the same class as celebrity clients.

- Accumulators seek to accumulate wealth out of an overriding concern for personal financial well-being. Their focus is on accumulation to protect against an uncertain future. By communicating a sense of urgency around financial performance, an advisor will be speaking to directly to the primary motivation of this group.

- Gamblers believe their skills and investment capabilities give them an advantage over the market. They are highly confident in their ability to manage their financial affairs. Advisors should emphasize their expertise in taking advantage of market volatility with this group. Gamblers typically prefer aggressive trading versus a buy-and-hold approach.

- Innovators believe the strength of their analytical approach will sustain them and protect them from external threats. They have learned to become highly self-reliant on their analytic capabilities over time and are typically hesitant in delegating any tasks having to do with analysis. Innovators communicate best with advisors who bring them leading edge investment opportunities and don’t shy away from technical discussions.

By identifying where a potential investor falls within these nine groups, you’ll be able determine their motivations and start speaking their language. You’ll also quickly identify which groups you best resonate with. When working with like-minded groups in which you can easily communicate, you and your client will enjoy a much more fulfilling relationship.

By leveraging these high net worth investor personas into your firm’s marketing, you’ll benefit from the power of segmentation and customized communication. Leading advisors are currently using marketing automation tools like HubSpot to develop personality-based lead nurturing campaigns that emphasize each group’s motivations and preferred communication styles. The result is a highly engaged pipeline of leads and new high net worth clients.

The complexity of the consumer decision-making process can often disrupt even the best business development programs. By identifying the motivation of your audience and having a platform to engage people in a scaled manner, you can attract and retain the right high net worth client for your firm.